What Is a Flood Zone?

The reality is that every area, to some degree, carries a risk of flooding.

Understanding Flood Zones: What You Need to Know

Flood risk can exist anywhere, but certain areas are more prone to flooding than others. For real estate purposes, the most concerning areas are the Special Flood Hazard Areas (SFHAs), or 100-year flood zones. Flood insurance is required for all federally backed and many private lending programs in SFHAs.

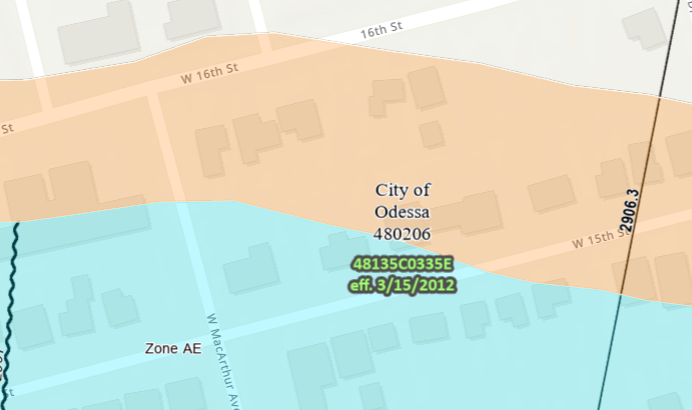

The 100-year flood zone AE is depicted as the blue area on the flood map, while the orange area is considered 500-year flood zones and not required for flood insurance by lenders.

Overlapping Structures in Flood Zones

Some structures on the margin of the 100-year flood zone may still be required to carry flood insurance. Fannie Mae/Freddie Mac loans have specific requirements for flood insurance, even for structures only marginally overlapped by the 100-year flood zone AE.

Changing Flood Maps and Removing Structures from SFHAs

FEMA has programs to change flood maps based on various variables. Individual building variables can also be presented to FEMA to remove structures from the SFHA. When a Letter of Map Amendment (LOMA) is issued for a property, structures are legally defined as part of the X-zone (500-year flood zone). For development and flood insurance purposes, structures in the X-zone are no longer considered part of the SFHA.